A quick-thinking title company owner was able to stop a fraudulent sale when it appeared the scammer was using AI to try to steal properties.

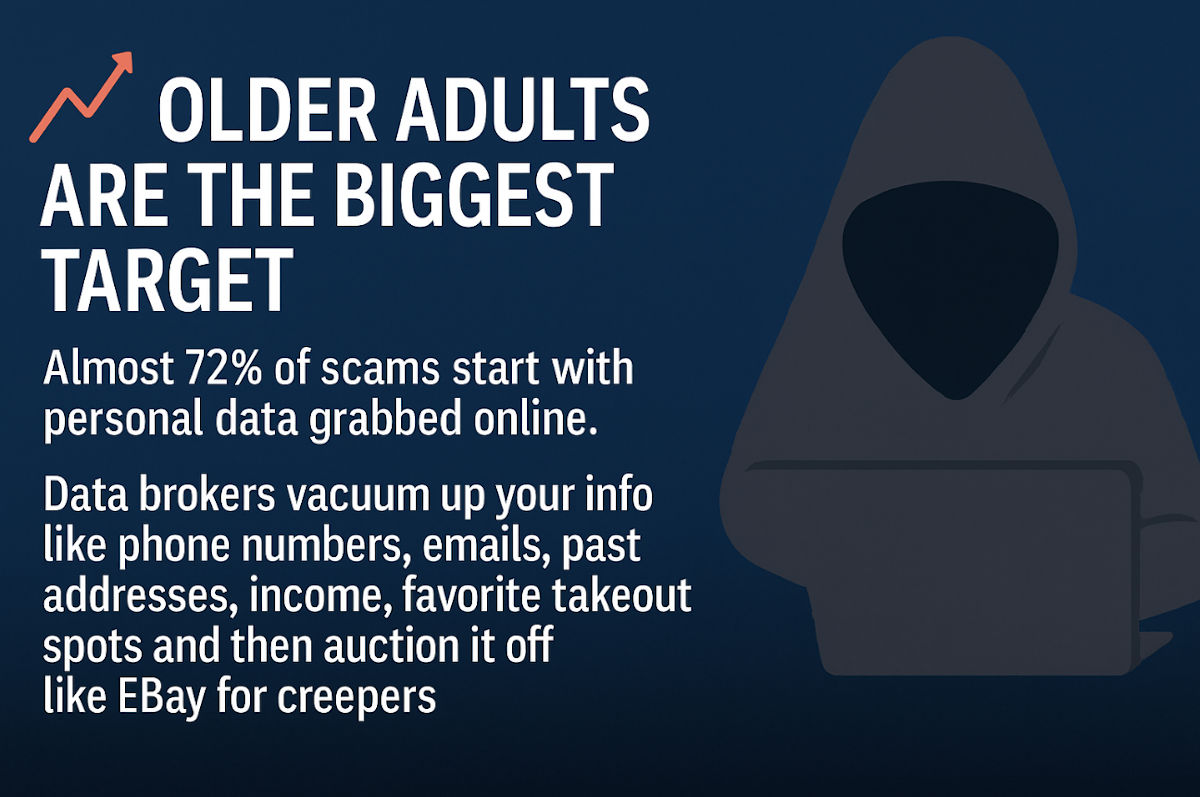

Elder fraud is exploding: Your data is making it worse

I’ve got bad news: Today’s online scammers know everything about you. They’re scraping your info and everyone else’s from the web and buying the rest from data brokers and people-search sites.

📈 The stats are scary

Folks age 60-plus are the biggest target. Almost 72% of scams start with personal data grabbed online. Data brokers vacuum up your info like phone numbers, emails, past addresses, income, favorite takeout spots and then auction it off like eBay for creepers.

With this data, they use personalized weapons.

🎯 Criminals know who to target

Study this list. Here’s what these attacks look like:

- AI phone calls that sound like your grandkids.

- Medicare fraud quoting your last doctor visit.

- Calls from “your bank” that know your address.

- Investment traps tailored to your retirement income.

- Romance scams where your “lover” has the same interests.

Live in a state with higher retirement incomes?

You’re in the bull’s-eye. Texas seniors lost an average of $51,700 per complaint. My state, Arizona, had the highest elder fraud rate per capita (3.5 cases for every 1,000 seniors). Yikes.

🛡️ How to fight back

1. Freeze your credit:

Even if you’re not worried about identity theft, a credit freeze keeps crooks from opening accounts in your name.

2. Use call filtering apps:

Try tools like Hiya, Nomorobo or your carrier’s spam call protection. And never answer unknown numbers, voicemail is your friend.

Why you can’t access some sites while you’re on a VPN and what to do

Let’s say you’re browsing the web with a VPN. You’re protecting privacy, so you’re confident hackers and advertisers can’t track you. Then you try to go to a site, and it just won’t load.

This can throw a wrench into productivity when working. Or it can ruin your mood when trying to have fun online.

‘It is not real': Title company owner warns of new twist to title fraud

Gen Alpha side hustles — June 21st, Hour 4

Gen Alpha isn’t only glued to the iPad. They’re making real money online. Here’s how. Then I talk to a caller who learns his sexy pics were part of a scam. Facebook fraud is exploding (shocker: Meta’s cashing in), and your printer is secretly tagging every page you print.

💬 Catfished by herself: One woman’s “online girlfriend” turned out to be … also herself? The digital muse/impersonator had built a fake Instagram to impersonate her, complete with matching tattoos, selfies and even unsolicited lewds, which the impostor was sending to other people. Love languages: words of affirmation, physical touch, identity fraud.

$225 million

That’s how much crypto the FBI wants to give back to scam victims. Unheard of, right? Usually, it’s “sorry for your loss,” but this time, federal agents are trying to return stolen Tether to 430+ duped investors. Sounds great until you realize crypto investment fraud racked up $9.3 billion in losses last year alone.

$32,000

That’s the life savings scammers stole from a schoolteacher in North Texas. They called pretending to be Chase Bank, saying his account was compromised and he needed to move his money to a “secure” one. It was all fake. The worst part? Chase only refunded about $2,000 since he wasn’t covered by fraud protection.

The scary new fraud your inbox can’t spot

AI is making scam emails look like the real deal. Double-check before you click, reply, or send money.

$9 billion

That’s how much fraud Apple says it’s blocked since 2019. The App Store stopped more than $9 billion in shady transactions over five years, with over $2 billion just last year. Add in nearly 2 million rejected apps and 711 fake customer accounts, Apple’s basically going full “you shall not pass” mode.

💸 Life savings wiped: Think these scams only happen to older adults? A 26-year-old lost over $30,000 after getting a fake text from “Wells Fargo” about a $1,300 charge. He replied no, got a call and scammers convinced him to transfer his money to a new account. Poof, all gone. FYI: Banks will never ask you to move your money to stop fraud.

23andMe data sold for $256M

Your DNA is now in the hands of biotech giant Regeneron. They say they’ll protect it. Plus, Owen Wilson deepfake scams, Meta lets fraud off the hook, and phone-free vacations. Got T-Mobile? Here’s how to claim your part of the $350M data breach settlement.

🚔 Crypto CEO sentenced: Alex Mashinsky, former Celsius Network CEO, just got slapped with 12 years for securities and commodities fraud (paywall link). Prosecutors wanted 20, but he got off slightly easier. Celsius collapsed in 2022, leaving a $1.19 billion crater. Turns out its slogan, “Unbank Yourself,” actually meant “Unpack Your Belongings in Cellblock D.”

💸 Fake it till you fund it: A tech founder got charged with fraud after lying about his shopping app, Nate, using AI for universal checkouts. Turns out it was actually human contractors from the Philippines and Romania behind the scenes (plus a few bots). He still raised over $40 million from investors before getting caught.

⚠️ Sam’s Club data breach: We don’t know a lot, yet. The Clop ransomware gang listed Sam’s Club on its leak site. All Sam’s Club says is that they’re investigating the matter. Better to be proactive. Watch your credit card statements for fraud.

Chase bank customers: Starting March 23, they’ll block Zelle payments tied to social media scams. Nearly 50% of Zelle fraud reports came from social media. If your payment gets denied, Chase will ask for more info. They should’ve done this sooner.

You’ve got 60 days to dispute bank fraud: A Denver woman’s SoFi account was drained of nearly $7,400 by scammers. The bank refused to reimburse her. She fought back and won. The takeaway? Act fast or they’re not liable.

It's (almost) always a scam

Scammers are using AI to pull off their most convincing tax fraud yet. Here’s what to watch for and how to protect yourself.

Disney’s employee troubles: A former Disney employee will plead guilty to computer fraud and identity theft. The guy was fired and charged after hacking restaurant menus. He added fake allergy-safe labels to items that contained things like peanuts and dairy, and he snuck in a swastika and references to mass shootings. Jail’s gonna be a whole new world for him.

🚨 Takeover fraud: A Colorado couple lost $3,700 after a scammer broke into their AT&T account and bought an iPad, iPhone, smartwatch and headphones. How? The crooks gained access to the couple’s login details. Keep an eye out for fake login links and impersonation calls. PSA: AT&T will never call you to lock down your account.

Check fraud up 400%

Scammers have stolen over $26 billion from Americans using an old-school crime with a modern twist. I’ll break it down in this quick podcast.